Boba - the trend of 2026

- Aminder

- Nov 24, 2025

- 4 min read

India’s age-old chai story is turning a page with the young and not so young catching on to the bubble tea trend.

2026 is the year of Bubble tea or Boba

The bubble tea market in India is projected to more than double from USD 450 million in 2024 to USD 930 million by 2033, with a CAGR of around 8.4% according to market research and advisory firm Custom Market Insights, turning it into a full-fledged 'Bubble Tea Party'.

And one that’s brewing across India – and ages. It’s almost everybody’s cup of tea.

Originally conceived in 1980s Taiwan as a refreshing treat for school children, bubble tea has since gone global, adopting many names along the way -- from ‘Boba’ and ‘QQ’ (a Chinese slang for chewy) to the playful ‘booboo’ in parts of the West.

India is catching up with brands like Boba Bhai, Nomi Tea, and Harajuku Tokyo Cafe leading the bubble tea trend in India

Key market trends

Rapid growth: The market is experiencing significant growth, with projections indicating it could more than double in value over the next decade.

Urban dominance: Major cities like Delhi, Mumbai, and Bengaluru are currently the leading markets due to higher disposable incomes and a concentration of cafés and food trends.

Flavor innovation: In addition to classic international flavors, there is a strong trend towards localized and innovative options that appeal to the Indian palate.

Customization and health consciousness: Brands are responding to health-conscious consumers by offering customizable sugar levels and sugar-free alternatives.

Accessibility: The market's reach is expanding beyond urban centers through franchise expansion and the growing popularity of online food delivery platforms.

Popular base and flavors: Black tea is a dominant base due to its familiarity and versatility. Fruit flavors currently account for the largest segment, while the chocolate flavor is expected to grow the fastest.

Driving factors

Evolving consumer preferences: Younger consumers are actively seeking new, flavorful, and experiential beverages.

Expansion of café culture: The growth of cafés provides a social setting and an ideal environment for consuming bubble tea.

Influence of social media: The "Instagram-able" nature of bubble tea has helped fuel its popularity.

Increased accessibility: The convenience of online ordering and delivery services makes it easier for more consumers to access bubble tea.

Growth drivers

A large reason for the growth of the brand is that the beverage in itself is hyper-customizable, with flavors ranging from the exotic Taro Lava Bubble to those specially created for the Indian subcontinent such as Kala Khatta Bubble tea. Adding to flavor customization is the fact that these teas can be created per customer with or without milk, thereby allowing local and global tastes to co-exist.

Cities such as Bengaluru, Delhi and Mumbai dominate the Indian bubble tea market primarily due to their urban lifestyle, high disposable income and a growing Cafe culture. These urban areas are hubs for culinary trends, attracting younger consumers who are more willing to experiment with different flavors and varieties.

Rising popularity of Asian flavors and culture, has contributed to the expansion of specialized tea outlets.

The market is segmented by flavor into classic milk tea, fruit-flavored tea, matcha flavored tea and others (such as taro and coffee) Recently, classic milk tea holds a dominant position under this segmentation due to its string appeal among Indian consumers. The rich and creamy texture combined with the familiarity of milk based beverages resonates well with local preferences, Additionally, many international and local brands offer innovative twists to the classic flavor, maintaining its popularity.

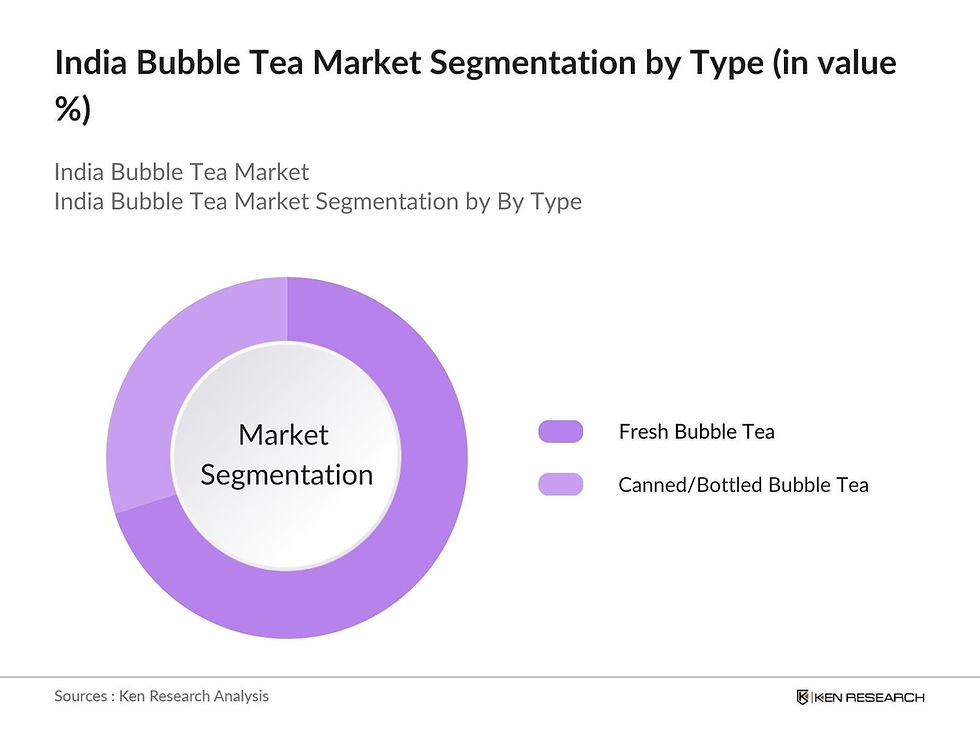

The market is segmented by type into fresh bubble tea and canned/bottled bubble tea, fresh bubble tea dominated the market due to the preference for freshly prepared beverages, particularly in urban cafe’ and specialty stores. Consumers appreciate the customizable nature of fresh bubble tea, where they can adjust sweetness levels and choose their preferred toppings, this type also benefits from the growing trend of experiential dining.

As of now, brands are dominating the metropolitan locations but soon enough, in the age of social media and fast changing trends, the evolution is going to be very fast. At The Restro Project, we believe this is going to accelerate with time and we also see market to evolve into three main segments of

Premiums - The market leaders in a way, dominating innovations and trends with an incredible focus on building a high end business. They would use the best of the ingredients, with most skilled team members. These brands would also be on the way to a markedly higher profitability levels. These businesses are very difficult to compete with.

Mass market - Small units mushrooming all around, they would be offering good bubble tea products at a remarkably lower prices, probably because they could be using slightly cheaper ingredients. The margins could be reasonable and they could be everywhere because with time the market entry points would reduce enormously.

In-between catchers - We call them the worst, they would be the locations which essentially stand for nothing and trying to catch up on the latest trends and mechanics. These players do not intend to develop skills either due to ignorance or a lack of business foresight. But they cut through the mass market players.

We believe the trend of Bubble tea would be there for another year and more, and many brands would be made and lost in the time.